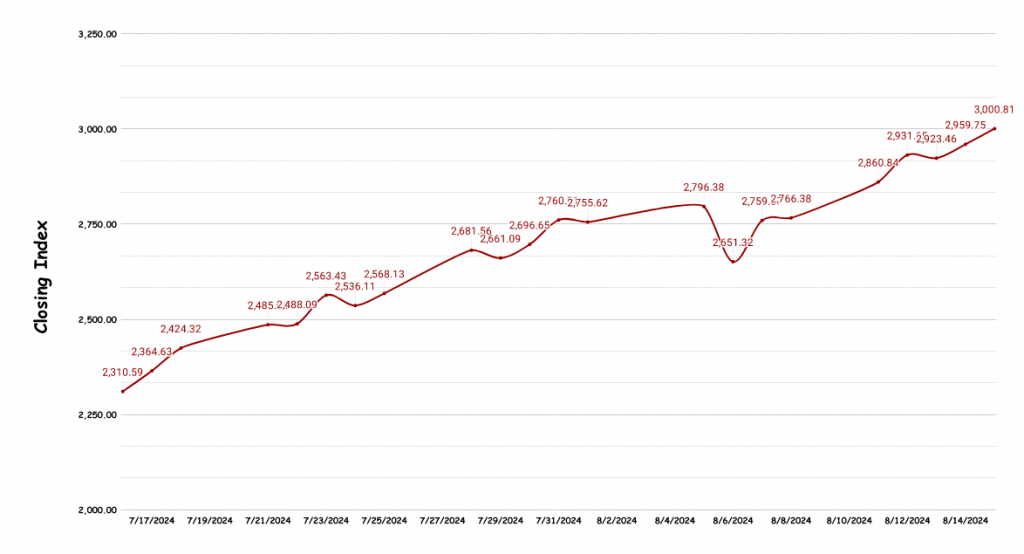

The Nepal Stock Exchange (NEPSE) this Thursday settled at 3,000.81 points following an increase of 43.1 points and a record turnover of NRs 29.31 billion.

After a series of bullish trends in the last 30 days, except for a few hiccups, the NEPSE reached the 3,000 mark in 29 months [NEPSE had earlier reached nearly 3,200 points in 2021].

In a matter of 30 days, the market increased by 760.40 points from 2,240.41 points on 15 July. The total turnover was NRs 422.17 billion averaging at NRs 18.36 billion [the market opened for 23 days in these 30 days].

As we discern the cause of this sharp rise over the last 30 days, we can shortlist it to recent political and policy changes, but there’s more to it than what appears on the surface.

What unfolded in the last 30 days?

The formation of the new government, including the appointment of Bishnu Poudel as the new finance minister [he also held the ministry previously between 2015 and 2016), and this year’s expansionary monetary policy are considered the pivotal events influencing the ongoing upward trajectory.

On July 15, the two leading parties — the Nepali Congress and the CPN-UML — forged an agreement to lead the government for the next 3.6 years. The probability that there will finally be political stability for the next three and half years is a fair reason to bolster investors’ confidence in the market.

The market was already showing growth momentum weeks prior to the formation of the new government as news started emerging about the coalition between the two leading parties of the country. The secondary market which opened at 2,051.92 points on June 30 closed at 2,204.61 points on July 11. Before, the NEPSE index had been exhibiting a downward trend with only some days with small gains in closing values.

Overall, this drastic improvement can be surmised to the positive outlook that investors had on the upcoming government.

The index then increased by 70.18 points with the total turnover amounting to NRs 9.73 billion the next day PM Oli was sworn in. The appointment of Bishnu Paudel as the finance minister, who is perceived as a stock-market-friendly politician, is also considered an influential factor.

Eleven days later, the NRB announced its new monetary policy, shifting to a more expansionary stance after maintaining tighter policies over the previous two years.

This year’s policy i) abolished the NRs 200 million ceiling on margin lending by banks and financial institutions (BFIs) to institutional investors, ii) extended the loan repayment period for construction businesses until the end of December 2024, iii) announced provisions for collateral-free loans for individuals seeking foreign employment, iv) lowered reserve requirements for banks and financial institutions (BFIs), like loan loss provisioning, and v) extended the period for implementation of variance analysis in the NRB’s Working Capital Loan Guideline, a measure that the private sector has been stingy about.

Investors responded with loud cheers to these policy changes with NEPSE closing at 2,681.56 points the day after — an increase of 113.42 points.

Most of these expansionary policy changes are expected to inject liquidity into the stock market, which typically benefits from such conditions. For instance, when liquidity was abundant, the stock market reached an all-time high of 3,198.60 in 2021. However, it later declined due to soaring inflation, high lending rates, and a shortage of loanable funds.

Presently, the market is also favoured by the current financial situation and the seemingly improving economy supported by ‘major’ macroeconomic drivers. Remittances have increased by 19.3% in Nepali rupees and 17.3% in dollars. Foreign exchange reserves have risen to $14.72 billion, up by 25.7% in the past 11 months. The banking sector is experiencing excess liquidity, which the NRB has been actively managing through different monetary instruments. Interest rates have fallen. Inflation has come to a moderate level.

Do these changes adequately explain the current bullish trend?

There are no such significant changes in the economy to justify the ongoing bullish trend. For instance, the last fiscal year the economy grew by a mere 3.87%. This year, the forecast stands at 6%, which isn’t that impressive either.

However, the NRB’s recent expansionary monetary policy suggests that the economy, which had been in a recessionary phase for the past two years following COVID-19, might emerge from that downturn. The policy shift is likely to increase economic activity but also draw investors to the stock market [to some extent already evident], especially given the lack of other investment opportunities.

That doesn’t imply that firms are already excelling enough to justify increased investment. Their financial performances over the past fiscal year have been relatively lackluster, which are typically essential to boost investor confidence.

For instance, the banking sub-index which accounted for 13.27% of the total NEPSE turnover [last 30 days] grew by 463.2 points. But the banking sector’s [A class commercial banks] total net profit recorded a growth of 13.4%, with only 10 banks recording an increase in their net profits. This was 25.03% in the last fiscal year.

For these reasons, observers allude to manipulation by larger players in the market. Many recent news reports suggest that major investments are pouring into underperforming companies, artificially inflating their stock prices. For instance, Bizmandu noted that out of the 17 companies that experienced positive circuits on 11 August, most were underperforming. The NEPSE surged by 94.46 points with turnover amounting to Rs 25.77 billion on that day.

Reports are also emerging that investors are resorting to online social forums, such as clubhouse, to drive up the prices of such stocks. Such practices aren’t something new.

In 2021, the Securities Board of Nepal (SEBON), the regulatory board for the stock market, found irregular trading practices in the transactions of 51 companies, highlighting significant risks for investors.

SEBON’s study revealed that activities such as insider trading and cornering were prevalent among the share transactions of those companies. The report indicated that large-scale investors were influencing share prices by injecting large sums to manipulate the market.

These arguments also hold water because there is no gradual progression in the ongoing bullish trend [see chart above], which is instead marked by sharp increases.

Amidst these developments, SEBON has remained leaderless for the last seven and a half months. The board, meant to be independent and authoritative, to secure protection for investors, lacks a chief clearly for political reasons and reportedly due to the influence of certain interest groups.