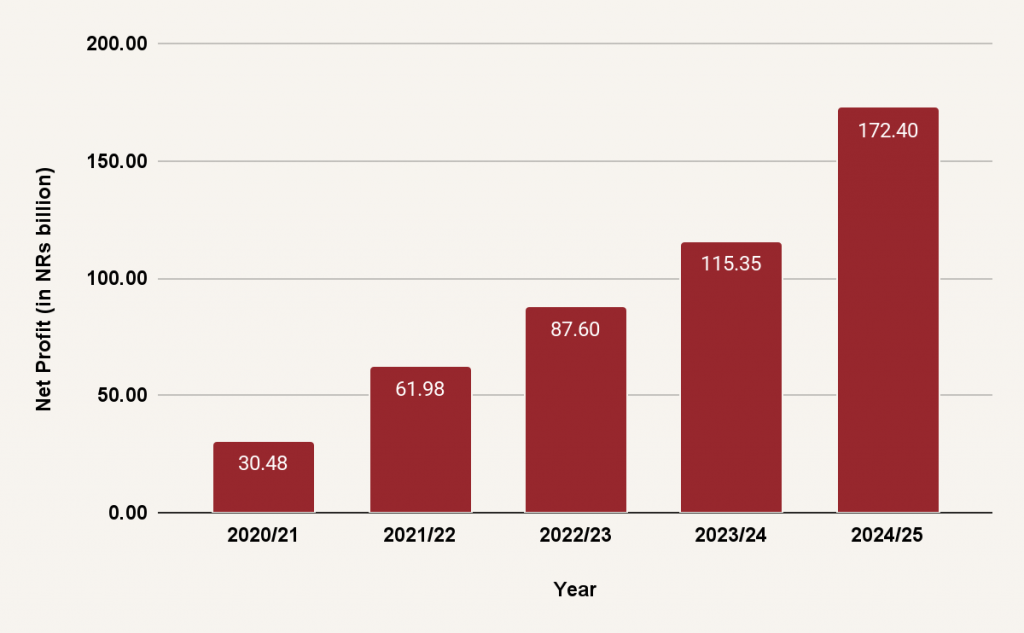

Nepal Rastra Bank posts a profit of NRs 172.3 billion; Surge by almost 50%

Nepal Rastra Bank reported a net profit of NRs 172.3 billion, a 49.45% increase from its previous fiscal year. A key factor anchors this windfall gain: foreign interest earnings of NRs 94.8 billion. Last year’s earnings amounted to NRs 78.16 billion, an increase of 21.3% this year.

With global rates remaining high, NRBs’ reserve assets earned more than at any point, and those returns reshaped the bank’s financial outcomes.

NRB profit: Five years overview

The central bank’s operating income reached NRs 88.5 billion, driven primarily by interest returns from overseas placement. Net interest income climbed to NRs 87.3 billion. It underscores that the bank’s reserve portfolio delivers a stronger, stable return, and foreign yield is a substantial contributor to the central bank’s financial performance.

Operating expenses stood at NRs 7.98 billion, with salaries, administrative expenses, depreciation, amortization, currency printing, etc., forming the bulk of the spending.

The institute sits on assets worth over NRs 2.6 trillion.

NRB continues an expansionary approach in its latest monetary policy review

Nepal Rastra Bank (NRB) has released its first-quarter review of its monetary policy, going on an interest cut spree. Despite abundant liquidity and low interest rates, private-sector borrowing remains stagnant. Credit growth has slipped to just 1.5%, a fraction of the 12% policy target, highlighting businesses’ continued reluctance to invest and expand.

In this backdrop, the central bank has further trimmed the policy rate from 4.5% to 4.25%. The main policy announced on July 11 had also lowered the policy rate to 4.5% from the existing 5%.

The following are all the adjustments made:

Interest rate corridor adjustment

- Upper limit under the Standing Liquidity Facility (SLF) lowered from 6% → 5.7%.

- Policy Rate reduced from 4.50% → 4.25%

- Lower limit under the Standing Deposit Facility (SDF) maintained at 2.75%

Relaxed policy measures

- The personal overdraft limit increased from NRs five million → NRs 10 million.

- Collateralised microfinance loan limit increased from NRs 700,000 lakh → NRs 1.5 million, with flexible repayment schedules

- Disaster-struck businesses and industries can restructure or reschedule their existing loans once. For this, they will have to pay 10% of their outstanding interest.

Operational and governance measures

- Banks are permitted to consolidate branches in metropolitan areas for efficiency

- All BFIs are required to implement anti-bribery and corruption policies, enhancing transparency and accountability

November records 116,553 tourist arrivals

Despite the domestic disturbances in September and predictions of a downturn in tourist arrivals, Nepal welcomed 116,553 foreign tourists in November 2025.

Among the source countries, India leads the pack at 18,995 arrivals, followed by the USA (11,254), China (7,871), the UK (7.189), and Bangladesh (5,653).

Regionally, 30,870 visitors (26.5%) arrived from South Asia, while 28,613 visitors (24.5%) from other Asian countries, 13,678 (11.7%) from the Americas, 5,891 (5.1%) from Europe, 1,802 (1.5%) from the Middle East, 412 (0.4%) from Africa, and 6,269 (5.4%) from other regions.

With impressive tourist arrivals in November, the total arrivals have crossed the figure of a million, with over 1.06 million tourists having entered Nepal by November. This influx has substantially contributed to foreign exchange reserves, with tourism receipts in the first quarter rising to NRs 19.2 billion, up from NRs 17.8 billion in the same period last year.

Nepal and Japan sign a concessional loan agreement to upgrade the Koteshwor intersection

The governments of Nepal and Japan have formalised a concessional loan agreement to fund the Koteshwor Intersection Improvement Project.

The project will overhaul one of Kathmandu’s most congested nodes by constructing a flyover and underpass along the Tinkune-Koteshwor-Jadibuti corridor. With this, the travel time between Tinkune and Jadibuti is estimated to reduce to 10 minutes from the current 40-60 minutes.

Japan will provide approximately ¥34.59 billion (almost NRs 31.76 billion) through its development agency, Japan International Cooperation Agency (JICA). The loan features favorable terms: a total of 40 years of repayment period with 10-year grace period and interest rate capped at 0.2% per annum.

On December 3, 2025, Finance Secretary Ghanshyam Upadhyaya and Japanese Ambassador Maeda Toru exchanged the agreement notes, confirming the Japanese cabinet’s approval of the loan. The loan agreement was signed by the Joint Secretary Dhaniram Sharma and the JICA representative, Matsuzaki Mizuki, finalising the financial terms.

The Koteshwor project aligns with Nepal’s broader urban development objective and highlights Japan’s continued role as a development partner, particularly in its infrastructure.

Arihants starts Nepal’s first gypsum industry

Arihant Infrastructure Limited is opening Nepal’s first factory producing gypsum board in Biratnagar. The factory is expected to start its production in early Poush. Until now, Nepal has relied entirely on imports for gypsum, mostly from Bhutan and India. Last fiscal year, import was valued at NRs 2.49 billion, totaling 354.9 million kg of gypsum.

Gypsum boards are widely used in construction, including wall partitions, tiles, and finishing works, providing fire resistance, sound insulation, and smooth surfaces for buildings. Reportedly, Arihant’s locally produced gypsum board is expected to be 50% cheaper than imported ones, primarily reducing the construction cost.

Perpetual preference share enters Nepal

SEBON has recently granted approval for the issuance of Perpetual Non-Cumulative Preference Shares (PNCPS), first to Nabil Bank, and now to Kamana Sewa Bikash Bank.

Think of these financial instruments as a hybrid of debt and equity, offering a fixed dividend only when profits are available, without piling up unpaid dividends for loss-making years. It is designed to restructure and strengthen capital without putting the pressure of a fixed redemption date.

Unlike the ordinary shares, these shares are reserved for institutional investors. Individual investors, mutual funds, and licensed market intermediaries are excluded to ensure these instruments remain in the hands capable of understanding their risks.

Under the NRB, these shares can be converted into equity shares if required, giving banks flexibility in restructuring their capital. Since the instrument will be listed in the secondary market, institutional investors will be able to trade it after issuance.